By Dietrich Knauth

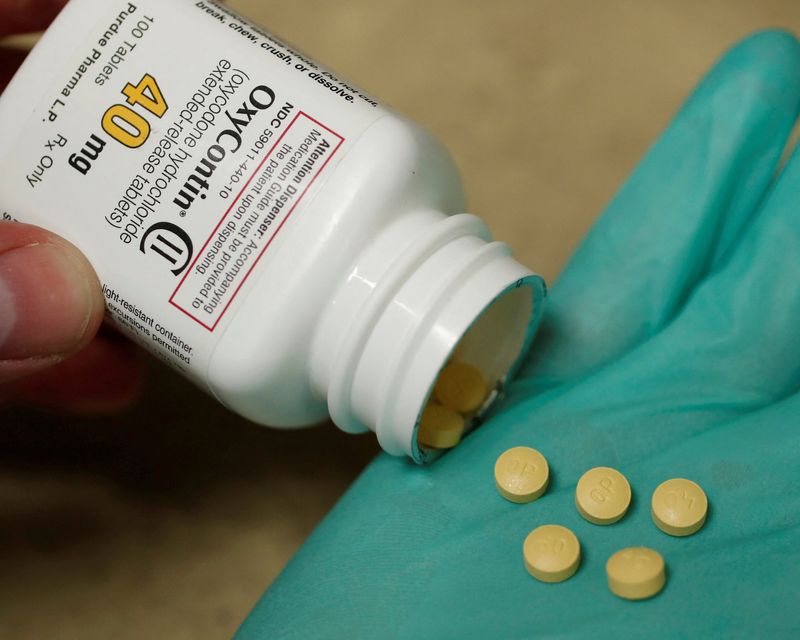

NEW YORK (Reuters) – Purdue Pharma said on Friday it needs more time to build support for a new $7.4 billion settlement that could complete the company’s years-long effort to resolve thousands of lawsuits over its addictive pain medication OxyContin.

The company still needs to hammer out remaining details and seek buy-in from states, local governments, and other creditors that have sued the company and its Sackler family owners over their roles in the deadly U.S. opioid epidemic.

Purdue attorney Benjamin Kaminetsky said at a court hearing in White Plains, New York that the company is “almost there” on a deal that was announced on Thursday by several states’ attorneys general and would propose a formal bankruptcy plan before the end of February.

U.S. Bankruptcy Judge Sean Lane, who is overseeing Purdue’s Chapter 11 proceedings, said the company is making concrete progress toward a deal and approved its request to pause all opioid lawsuits against the Sacklers at least until the end of February.

The bankruptcy case has stopped litigation from proceeding against the Sacklers and Purdue, since the company entered Chapter 11 in 2019, and Lane has granted several short-term extensions of the litigation ceasefire in recent months.

“We’ve been doing this for some time now, and the hope is that we’re getting toward the end,” Lane said on Friday.

Purdue filed for bankruptcy in 2019 in the face of thousands of lawsuits accusing it and Sackler family members of fueling the epidemic through deceptive marketing of OxyContin. Drug manufacturers, distributors, pharmacy operators and others have collectively agreed to pay about $50 billion to resolve similar lawsuits and investigations related to the U.S. opioid crisis.

The new deal, supported by 15 states, offers the company a fresh chance to conclude its long-running bankruptcy after the U.S. Supreme Court scuttled its previous opioid settlement. But it faces a long and uncertain road before the settlement is approved and funds can begin flowing to states, communities and individuals that were harmed by the crisis.

The deal has not yet been reviewed by most of Purdue’s creditors, including the states, local governments, and individuals that have legal claims against the Sacklers.

Key terms of the settlement will be published next week, said David Nachman, an attorney representing New York state. The states that negotiated the deal, including New York, California, Texas and West Virginia, are circulating it to other states to encourage them to support the deal.

“We have work to do to build that consensus, and we are confident that we will be able to do so,” Nachman said.

The new settlement comes seven months after the Supreme Court ruled that the Sacklers, who did not file for bankruptcy themselves, were not entitled to sweeping legal protections meant to give bankrupt debtors a fresh start.

The settlement does not fully shut off lawsuits from states, local governments, or others who would prefer to opt out of the deal and instead sue the Sacklers, who have said they would vigorously defend themselves in court.

The deal is not yet binding even for the 15 states that negotiated it. West Virginia currently supports the deal, but it retains the ability to opt out and litigate separately, according to a spokesman for attorney general John McCuskey.

Lane said creditors, including individuals who were personally harmed by the opioid crisis, will need to be patient as the settlement develops.

“People need to know what benefits the bankruptcy case can bring them before they decide whether other options are the best way to proceed,” Lane said.